Plastic film market risks for sharply increasing of its price

Recently, due to the deteriorating situation in Libya, crude oil reserves and export facilities are threatened, stimulate the market to the global oil supply and concerns about the risk of inflation increased sharply.

Libyan crude oil prices caused unrest

International crude oil prices greater impact on the plastics market in China. Downstream plastic products as crude oil, and crude oil prices are not synchronized, such as cycle was delayed. However, the current market price volatility of view, this lag effect become shorter. The impact of oil prices on the plastic theory was weakening in the relationship between the crude oil price fluctuations could be weakening of the industrial chain. Rise in crude oil prices in the period or the case of falling cycle, plastic raw materials and prices tend to rise or fall in the corresponding period of increase or decrease the cost of plastic role in promoting more and more evident.

Countries affected by the crude oil into "stagflation"

OPEC member Libya's situation with the continued turmoil in the past two days continuously rising international oil prices, New York and London the price of benchmark crude oil reached a new high of more than two years. Some industry insiders believe that the current oil market situation due to volatile geopolitical situation, somewhat similar. Recently, even the news that Libya's oil facilities to the Mediterranean region may face the risk of being destroyed.

Birol, chief economist at the International Energy Agency pointed out that the political situation in the Middle East and North Africa, oil prices could pose long-term development impact, because according to the organization predicts that the next 10 years, the world's new oil production will come from the Middle East 90% and North Africa, while other areas of the oil production is declining.

International oil prices chart

BNP Paribas commodity strategist Harry said that the current changes in the factors that led to the crude oil market, the war in Iraq in 2003 is somewhat similar to the case when, oil prices are reflecting supply disruptions in the worst possible situation. The only difference is that "now not clearly foreseen in the Middle East turmoil could last long."

It is understood that Libya is the world's 12th largest oil exporting country, about 160 million barrels of crude oil per day, most of them export to Europe. In addition, as a member of OPEC, Libya is Africa's largest oil reserves in the country.

Wall Street celebrities, Pacific Investment Management Company CEO 埃尔埃利安 said the situation in Libya and other countries, it might give the global economy, especially in Western countries has brought "stagflation" of the risk. He pointed out that if oil prices due to geopolitical situation remain high, the West will face accelerating inflation; the other hand, the Middle East and North Africa, demand for exports to developed countries substantially reduced, along with its high unemployment and economic growth lower than historical level, developed countries could fall into "stagflation."

LLDPE conflict situation caused by sharply lower

Libya and the Middle East are destabilizing the situation in upgrading the supply of reconstruction after the earthquake in Japan may increase demand, international oil prices has also been supported. However, the debt crisis of the market in Europe remains cautious on the economic impact of Japan's nuclear crisis, there are certain variables that inhibit further increases in oil prices.

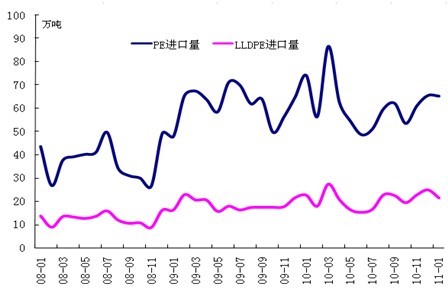

China PE and LLDPE imports

Lack of demand on the downstream market, the mentality of PE influential, short bounce rate would be slower. The bottom of the price of basic set of plastic, the market outlook will be repeated shocks. Futures trading weak drag down the atmosphere, near the end of the supply is normal, businesses offer slightly lower linear, end demand is still not optimistic, the actual turnover of more than talk. Quoted in the mainstream market LLDPE 10950-11100 yuan / ton.

LLDPE sharply lower today, the major 1109 contract opened at 12,065, up 12,090, minimum 11,760, to close at 11,830, was down 235. Overall, the price of oil rose to the highest point in two years, the cost of the PE market push is inevitable. Although LLDPE fell sharply today, but the market outlook, the larger the probability of PE market rebound. Of course, lack of demand on the PE market is also quite the mentality of the downstream effects of short bounce rate would be slower. The bottom of the price of basic set of plastic, the market outlook will be repeated shocks.

The North PE prices stabilize, closing in general, strong intention to ship the end of business, poor demand for products manufacturers in North China. Yuyao some slight fluctuations in PE market, the overall stabilizing transactions, shipping in general, the basic stability of supply, some varieties of a firm offer to talk about. LLDPE mainstream price 11000-11100 yuan / ton. South PE prices were stable, the general inquiry, reported near the end of the basic stability of the mainstream business, the poor performance of downstream demand.

Asian ethylene prices may rebound in the disadvantaged

Although the upstream crude oil market is firm upstream of ethylene, but by the downstream effects of ethylene weak physical demand, the Asian ethylene market continued weak environment.

PE domestic market price chart

Ethylene markets in Asia fell this week after the first up, weekly although South Korea and Japan are more regional petrochemical plant maintenance, but obviously the downstream polyethylene market upside down, petrochemical plant operating rates fell, increasing supply of goods ethylene, ethylene market offer fell $ 5 / tons; the weekend by the Japanese earthquake and nuclear radiation, naphtha cracker operating rates fell, leading to rising naphtha offer 40 dollars / ton, and the reduced supply of ethylene, ethylene market go up 5-20 dollars / ton, particularly in Northeast Asia markets rise, the market in Northeast Asia offer $ 1,341 / tonne CFR, Southeast Asian markets offer $ 1,256 / tonne CFR. However, demand remained weak ethylene downstream, suppression of ethylene market upside.

It is understood that the Asian ethylene market was steady at $ 1,340, respectively, / ton CFR North East Asia, and $ 1,301 / ton CFR South East Asia. Although the seller negotiate the price of not less than $ 1,350 / tonne CFR Northeast Asia, but in the end of March before the unit began to focus on maintenance vinyl floor physical demand is limited. Ethylene by weak demand in Asia, which some traders continue to seek opportunities to ethylene Chuanhuo sold in Europe. It is reported that, CIF Northwest Europe benchmark ethylene price in 1565 U.S. dollars / ton level. Last week, a group of Asian spot ethylene cargoes of 10,000 tons has been exported to Europe. A trader said the tight supply of ethylene to compensate the Libyan situation, many European manufacturers is on the downstream areas shopped spot ethylene vinyl cargo. But some traders said the stock by the increase in the Middle East influence of ethylene, the ethylene cargo sold to Europe, Asia is more difficult. Downstream users because of the procurement in Europe in the Middle East than in Asia, ethylene shipments faster and cheaper.

Crude oil prices led to rising prices of plastic products

Affected by the financial crisis, is widely expected to show the economic downturn and lack of confidence in the international economic cold snap, leading to international oil prices from nearly 150 U.S. dollars a barrel in the first half fell sharply and fell below $ 50 mark. Massive decline in investor confidence in the fight against the market, while OPEC and other oil producers have also led to lower oil production, which dragged down the domestic petrochemical industry. Downturn in the petrochemical industry, plastic has a direct impact on new material prices.

Recently, Xiao Bian wholesale market to buy an ordinary plastic small plastic pots to 2.5 yuan, but only 2 yuan a month ago. Also with the price increases with the plastic pots plastic flower pots, plastic containers, plastic toys. Prices of plastic products mainly because of persistent high oil prices.

Bosses plastics market analysis that "price chain": Crude oil prices - plastic raw material prices - prices of plastic products. Plastic products, raw materials, such as polyethylene, are all derived from petroleum. Therefore, when the prices inevitably so.

Chongqing and other places most of plastic products were from Zhejiang, Zhejiang Packaging Technology Association confirmed that the fastest rising prices of raw materials or up to 50%. Recently, polyethylene, polypropylene and other plastic products, raw materials prices are rising, in several hundred dollars per ton increase to several thousand dollars.

According to industry analysts, crude oil prices affect the price of plastic products, which requires a process. However, the price of plastic raw materials have risen, will inevitably cause the price of plastic products, the prices of the period should be limited by the impact of the situation in Libya.

Libya volatility of the situation, leading to soaring crude oil prices, not only restricted the development of the industry in developed countries, and thus indirectly affect the domestic plastic market in China. If you continue to maintain high international crude oil, ethylene prices are expected in the coming months will be difficult to drop out of the clear trend, while the cost of plastic products will continue to rise, to bring China's plastics industry is expected to influence not.

|